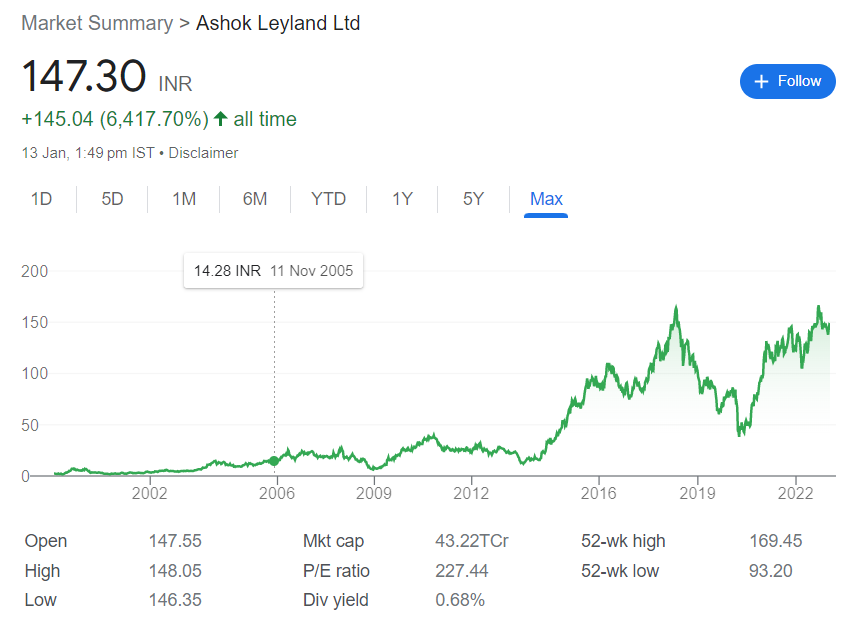

We will discuss the performance potential of Ashok Leyland and discuss its share price targets for 2023, 2024, 2025, 2026, 2030, 2040, and 2050. Along with the expansion of the overall auto industry, Ashok Leyland’s share price has rapidly increased from its low point.

Given its record, many long-term investors appear to be placing their faith in this stock. We will examine Ashok Leyland’s potential future opportunities today in order to understand how the stock price of the company will develop over the following years.

Ashok Leyland share price target prediction 2023

Sales of commercial vehicles experienced a very good development as a result of the pandemic’s gradual environmental recovery and the rise in demand for automobiles. Due to its significant market position in the commercial vehicle sector, Ashok Leyland appears to be benefiting from this expansion.

Along with growth in all rural areas and an improvement in peoples’ economic circumstances, there is also an increase in demand for commercial vehicles, which will soon benefit both Ashok Leyland and the rest of the corporation.

If seen in a short period of time, Ashok Leyland’s share price objective until 2023 will be shown exhibiting the initial target of Rs. 172 per share due to the rising sales. You should expect to see a target of Rs. 185 as soon as this one starts to become profitable.

Ashok Leyland share price target prediction 2024

The second-largest producer of commercial vehicles in India and the fourth-largest bus manufacturer globally are both Ashok Leyland. The fact that Ashok Leyland is present in nearly 50 countries and has more than 9 manufacturing facilities spread all around the globe speaks volumes about the company’s strength.

As a result of Ashok Leyland’s substantial market share in virtually every market for commercial vehicles, there are also tremendous potential in the near future. The vehicle requirements of the Indian defense industry appear to be quite effectively met by Ashok Leyland.

Looking at Ashok Leyland’s strong market share until the year 2024, you can see that the share price goal is Rs 220. Following that, you can consider establishing a second goal for Rs. 240.

Ashok Leyland share price target prediction 2025

Electric vehicles are the way of the future, and Ashok Leyland is making significant investments in this area of research and development. Due to Ashok Leyland’s robust R&D efforts, the nation’s first electric bus recently entered service.

With the company’s continued success and new developments, there is a strong likelihood that the business will expand successfully. In the upcoming years, the management intends to integrate Flash Charge in electric buses together with additional technologies. You will observe an increase in the share price in line with the company’s progress in the electric car market.

The Ashok Leyland share price target 2025 is anticipated to show you the initial target of Rs 350 while giving strong returns, taking into account the company’s growth. The second goal can then be set to be a profit of Rs. 375.

Ashok Leyland share price target prediction 2026

Ashok Leyland share price target prediction, we expects the share price by 2026 can go upto Rs 400.

Ashok Leyland share price target prediction 2030

If you take a thorough look at Ashok Leyland’s operations, you will see that the company’s operations are anticipated to expand along with the Indian economy. due to the fact that Ashok Leyland relies heavily on commercial vehicles, which are employed in both business and construction.

India is a developing nation, thus there is a great chance that the long-term need for commercial cars would rise gradually and quickly.

Looking at the long-term share price goal of 2030 for Ashok Leyland, you can see the potential for trading around Rs 700 with excellent profits.

Ashok Leyland share price target prediction 2040

Taking into account the company’s potential for long-term business growth, the Ashok Leyland Share Price Target 2040 can show that the share price will be around Rs 1300 and that owners will make a lot of money.

Ashok Leyland share price target prediction 2050

When the company’s potential for long-term business growth is taken into account, Ashok Leyland Share Price Prediction 2050 has the ability to put the share price at around Rs 2400 and give the share holders great returns.

Frequently Asked Questions

What is the Future of Ashok Leyland Share?

With an eye toward the future, Ashok Leyland has long been moving its business forward quickly. Due to the management’s solid long-term experience, there is a strong likelihood that the company will continue to grow successfully in the future.

Good new ideas have occasionally been made by Ashok Leyland; if Ashok Leyland keeps putting more emphasis on innovation in the future, the company will grow in line with that.

Is Ashok Leyland Share a Risky Share?

The largest danger to Ashok Leyland’s business is that its rival Tata Motors is steadily expanding its market share. If management does not make wise decisions at the appropriate times, this risk will eventually start to affect Ashok Leyland’s business.

The company is regularly observed taking out large loans to develop its electric vehicle section, which poses a second danger. Over time, the company may experience some financial difficulties as a result of a rise in the amount of interest.

Due to the cyclical nature of the commercial vehicle industry, this sector will experience significant booms and recessions over time. Although the company’s operation offers a lot of opportunities, its risk should never be completely disregarded.

Therefore, if you intend to invest, you should wait until the company’s performance is deemed to be improving before considering doing so. But before making any investing decisions, don’t forget to consult your financial counselor once.

Ashok Leyland: Does it pay dividends?

Yes but very little. Its not the good share in terms of dividends.

Ashok Leyland: Is it a debt free company?

No its not debt free. Given that Ashok Leyland has an unsettlingly high debt to equity ratio of 3.16, it suggests that company frequently uses debt to increase returns.

What kind of future does Ashok Leyland Share have?

Given its business’s potential for expansion, Ashok Leyland has the capacity to do well in the future.

When is it right to buy Ashok Leyland shares?

If you notice a minor fall in the Ashok Leyland Share, you should consider investing gently over an extended period of time.

Conclusion

After reading our article on Ashok Leyland Share Price Target 2023, 2024, 2025, 2026, 2030, 2040, 2050, we hope you have a solid understanding of the direction that the company’s growth is anticipated to take in the next years. Do not hesitate to ask in the comment box if you still have any questions about this post.

Join Ashok Leyland Share Discussion/Forum

| Telegram | https://t.me/+hb3V_4xq-h9lOGU9 |